30+ Credit card borrowing capacity

For example if you have a 5000 credit card limit and you owe 1000 on that card the math for. Find out what your borrowing capacity could look like and how a credit card can affect this.

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

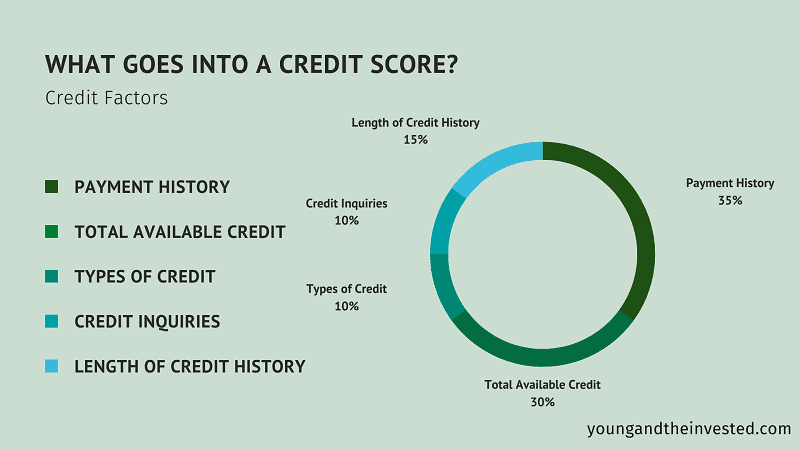

Multiply your number by 100 to see your credit utilization as a percentage.

. Did you know a 10000 credit card could reduce your borrowing capacity by as much as 50000 - even if you never use the cardIn the eyes of many banks tod. I suppose it only works with those that can afford to. If you have a credit card where you can earn 50000 points after spending 2000 you are getting 25 points per dollar for that first 2000 in spending.

Aim for a total utilization ratio and ratios for each credit card of no more than 30. It is also worth noting that when taking your monthly expenses into account lenders assess the minimum monthly payment on your credit card at 3 of the credit cards. Large Capacity Genuine Leather Bifold WalletCredit Card Holder for Men with 15 Card Slots QB-027 Blue 46 out of 5 stars 14503 2788 27.

The Bank of England said borrowing on all forms of consumer credit was lower than in May when it rose to 18bn but remained above the 12-month pre-pandemic average. 192 views 6 likes 0 loves 0 comments 3 shares Facebook Watch Videos from Switch Finance. The Bank of Spain advises that the.

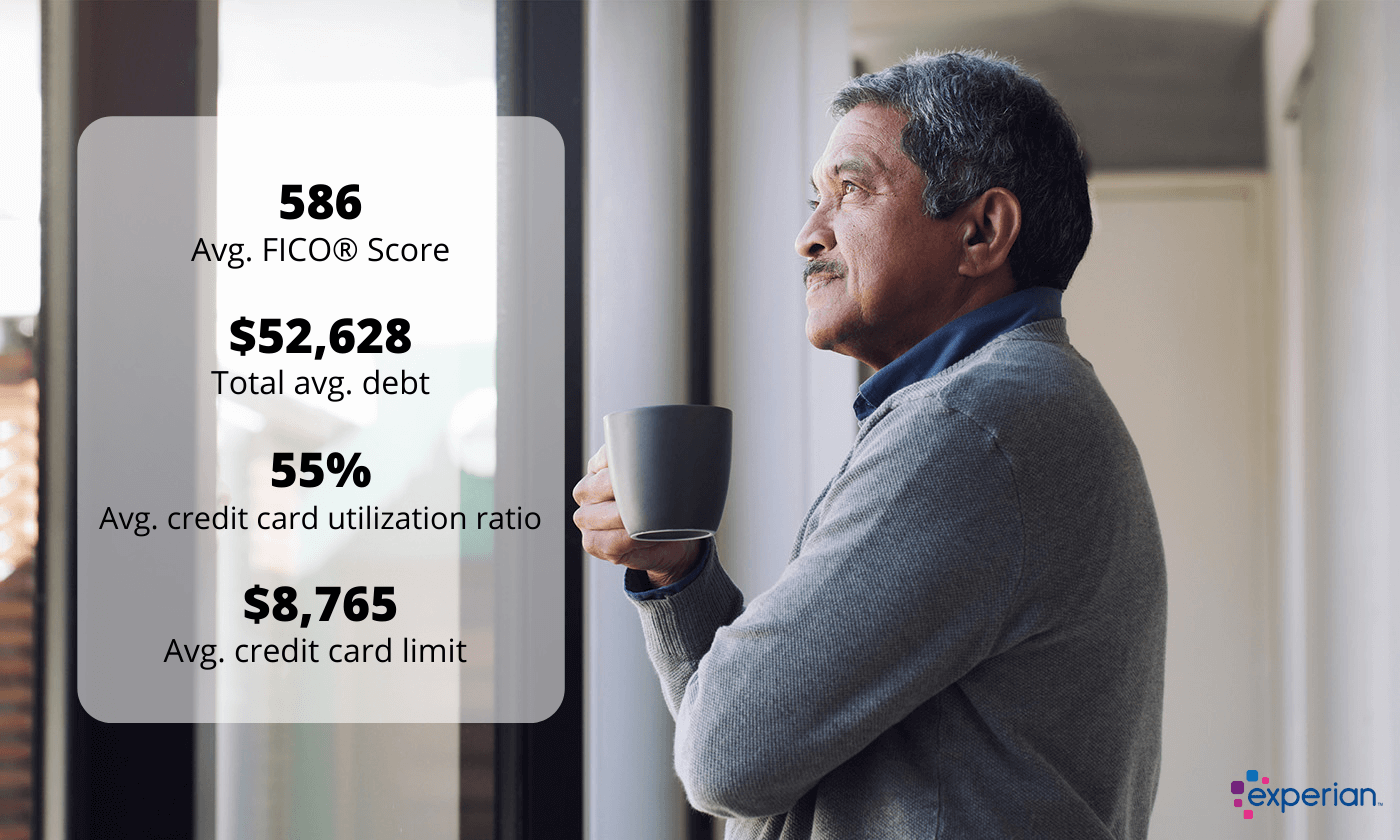

The 30 answer finds backing from the credit bureau Experian. The 30 level is not a target but rather is a maximum limit. Besides that look for cards that give.

Your total gross income salary 50000 plus 80 of projected rental income. Exceeding that level will have significantly negative impact on credit. Lenders assess based on the credit card limit NOT on what you owe.

It is treated as another loan or commitment. Its calculated based on your basic financial information such as your income and current debt. Your credit score will take a bigger hit once your utilization goes above that.

Simply owning a credit card impacts your borrowing power. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. Divide this amount by the interest rate to derive your total borrowing capacity.

Did you know a 10000 credit card limit could reduce your borrowing capacity by 50000. Meanwhile the average interest rate on credit card borrowing rose by 217 to its highest rate since 1998. No credit check is involved nor is it a guarantee of the approved financing which you may.

Why you can trust Sky News. Tuesday 30 August 2022 1505 UK. Credit cards can absolutely be part of a.

Credit card paperwork for loan applications. How many people cancel their cards before applying for the loan and then reapply for the cards after they have got the loan.

Oportun Provides Business Update Oportun Financial Corp

9 Credit Cards For No Credit History Starter Credit Cards

Average Credit Card Debt In America 2022 Elite Personal Finance

Ipcbwal8bxmx0m

Fewer Subprime Consumers Across U S In 2021 Experian

People Trying To Dodge Legal Usury Credit Card Balances Delinquencies Third Party Collections And Bankruptcies In Q2 Koolplaz

Best Credit Cards For Bad Credit Of September 2022 Creditcards Com

Average Credit Card Debt In America 2022 Elite Personal Finance

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street

Average Credit Card Debt In America 2022 Elite Personal Finance

People Trying To Dodge Legal Usury Credit Card Balances Delinquencies Third Party Collections And Bankruptcies In Q2 Searchinicio

Best Crypto Credit Cards Of 2022 Crypto Cards

How To Avoid Falling Into The Credit Card Trap Is It Okay To Pay The Minimum Amount Due Every Time Quora

How Many Credit Cards Should I Have Until It S Too Many

Do Nudges Reduce Borrowing And Consumer Confusion In The Credit Card Market Adams 2022 Economica Wiley Online Library

Syf 20201231

The State Of The American Debt Slaves Q1 2019 Wolf Street